Canada Post service disruption is in effect. Please call us if you need assistance. Intact Insurance clients: easily access your documents through the app or Client Centre.

AccèsConseil joins the Ellipse Group. We are joining forces to better serve our clients and grow our teams. Read the official press release

RRSP or TFSA?

A question on a lot of minds as we approach the deadline for contributing to an RRSP. Let’s untangle a few notions and go over each one’s purpose.

RRSP: Registered retirement savings plan

As the name suggests, this is a savings plan designed to help you save for your retirement.

The idea: the contribution is deductible, which gives you immediate tax savings. Your savings are entirely tax-sheltered, as long as they stay within the plan. However, when you withdraw your investments, they will be taxed. You can deposit up to 18% of your annual income each year, up to a maximum amount.

How can an RRSP be useful?

There are many cases in which an RRSP can be an ideal asset:

- To buy or build your first home through the Home Buyers’ plan (HBP)

- Finance lifelong learning (LLP)

- Save for retirement

TFSA: Tax-free savings account

The TFSA works a little differently. Money in this plan does not give you a tax deduction. But in return, your withdrawals are not taxable either. Major difference from RRSPs: your savings grow tax free and you can withdraw whenever you want without having to worry about taxes.

The calculation of the contribution limit is also different from the RRSP. Actually, when this plan was created in 2009, the ceiling was $ 5,000 a year. As of 2013, it has been adjusted to $ 5,500. It should also be noted that in 2015, the contribution limit was increased to $ 10,000 and then dropped to $ 5,500 the following year. In 2019, to adjust to inflation, this ceiling is now $ 6,000 a year. To date, in 2019, your maximum total contribution is therefore $ 63,500.

How can a TFSA be useful?

- To save for retirement

- To renovate the house

- To buy a car

- To start a business

- To go on a trip

When is it advantageous to contribute to an RRSP?

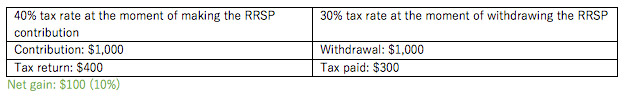

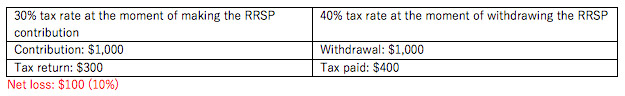

An RRSP is advantageous when your taxable salary (and therefore your tax rate) is greater, as it is during your career, and not when you retire. For example, if your tax rate is 40% on the RRSP contribution and 30% on the withdrawal, it becomes interesting. You will actually save 10% by investing in an RRSP! If you expect to have a higher tax rate at the withdrawal than the contribution, then the opposite effect will occur, and you will have a tax loss.

Let’s have a look at a concrete example:

Scenario #1

Scenario #2

RRSP or TFSA? When your situation looks like scenario 2, it would be a good idea to focus on the TFSA. And did you think about the RESP?

As you can see, every situation is different. Take the time to analyze yours with a trusted professional.

Contact us!